Auripeak is a privacy-first liquidity intelligence platform built for independent operators facing irregular income cycles.

How Auripeak Protects Your Liquidity

Powered by Auri, your intelligent finance system that gives your business real-time insights, cash-flow predictions, and smarter decisions not just reports.

Privacy-First by Design

Your financial data belongs to you. Auripeak protects it with strong encryption, strict access controls, and a policy of never selling or sharing user data.

Auri Liquidity Intelligence

Auri helps you see financial pressure before it happens. It analyzes your invoices, expenses, and balances to surface early signals of liquidity risk while you stay fully in control of every decision.

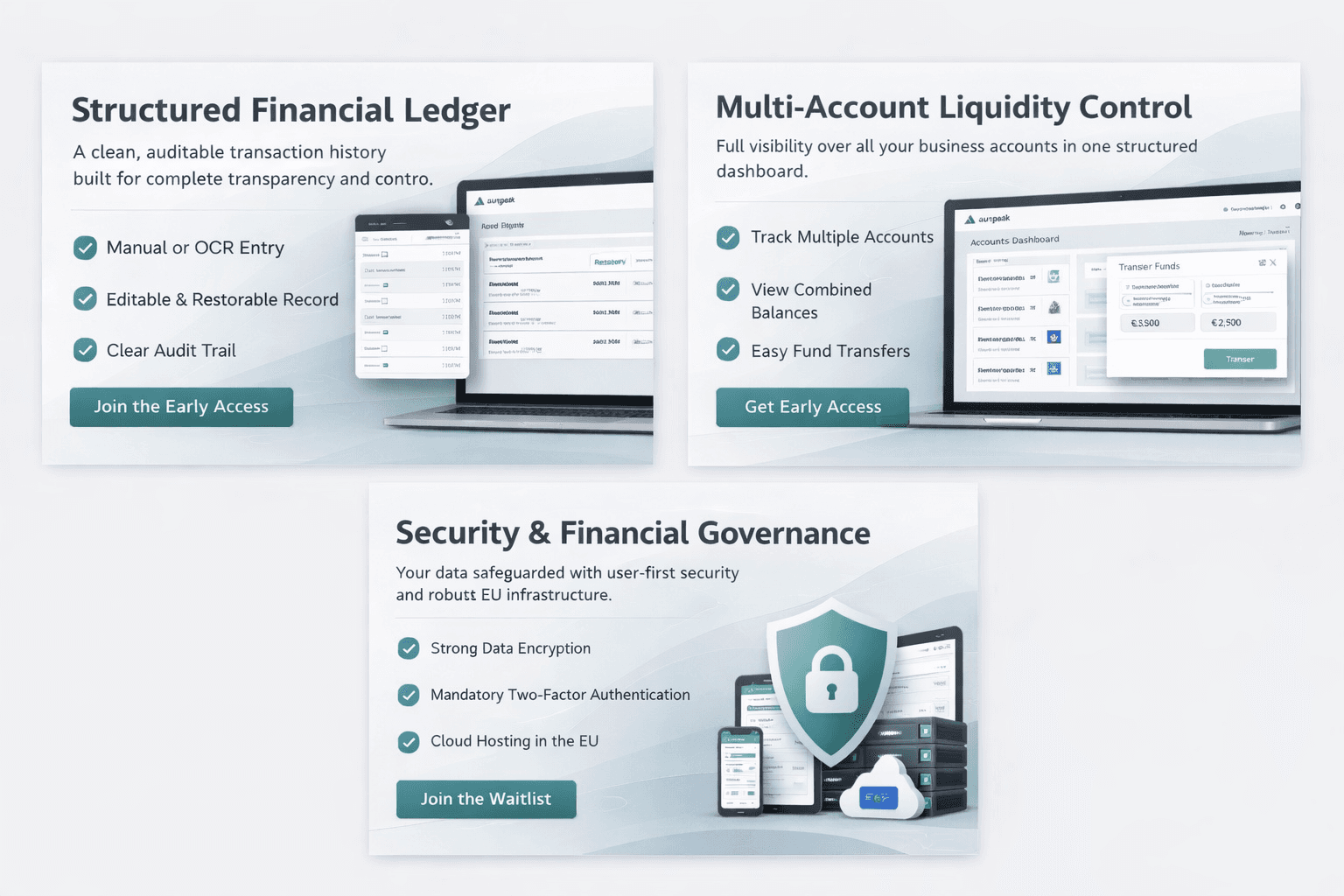

Structured Transaction Ledger

Keep a clean and reliable financial record. Transactions can be entered manually or captured with OCR, while edits and history tracking keep your ledger transparent and auditable.

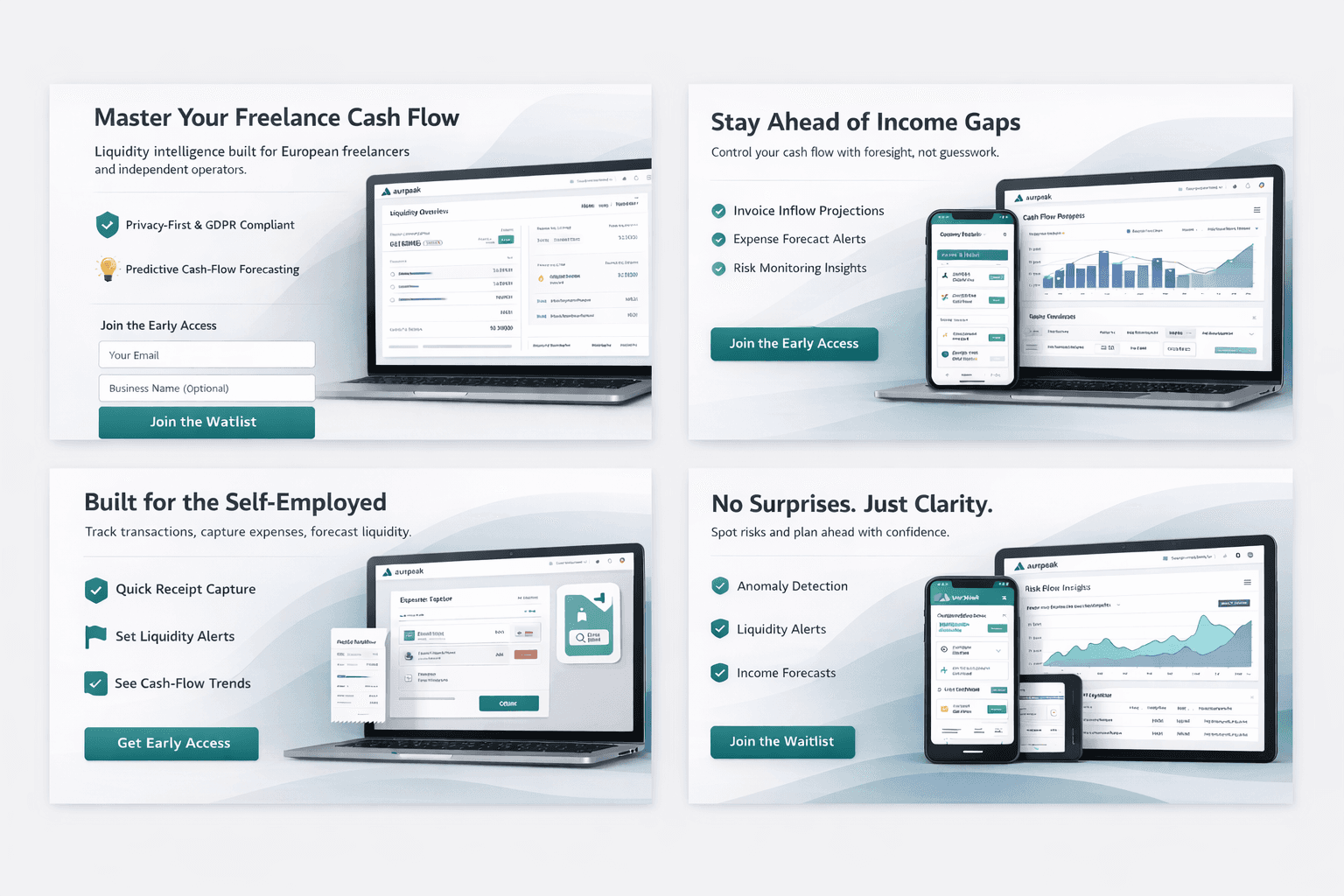

Fast Expense & Receipt Capture

Capture receipts and expenses in seconds. Auripeak uses OCR-assisted input so you can record costs quickly without interrupting your workflow.

Multi-Account Visibility

See the full picture of your liquidity. Track balances across multiple accounts in one place so you always know where your cash actually stands.

Budget & Liquidity Controls

Set limits for spending and operating cash. Auripeak helps you monitor variance in real time so financial surprises don’t catch you off guard.

Predictive Cash-Flow Forecasting

Understand where your cash position is heading. Auripeak projects upcoming invoice inflows, expenses, and obligations so you can spot liquidity gaps early.

Risk Monitoring

Auripeak continuously checks for unusual transactions, spending spikes, or structural cash-flow pressure so you can respond before problems escalate.

Liquidity Action Guidance

When cash pressure appears, Auripeak doesn't just show charts. It highlights the actions that can protect your liquidity — such as invoices that need chasing, expenses that can be delayed, or gaps that require attention.

Operational Finance Dashboard

A clear weekly view of income, expenses, runway, and liquidity exposure so you can understand your financial position at a glance.

Reliability & Data Integrity

Built with validation safeguards and consistency checks so the financial data you rely on remains accurate and trustworthy.

Security & Access Protection

Multi-layer encryption and optional two-factor authentication protect your financial workspace and control who can access it.

Transparent SaaS Pricing

A straightforward subscription model. No commissions, no financial product incentives, and no hidden monetization tied to your data.

Auripeak Frequently Asked Questions (FAQ)

Auripeak is a liquidity intelligence workspace for independent operators and small businesses. It helps you track transactions, invoices, and expenses while giving forward visibility into your cash position so you can see pressure building before it becomes a problem.

Many operators earn good revenue but still run into cash pressure because payments arrive late and expenses do not wait. Auripeak focuses on liquidity visibility so you know when a shortfall is coming and what action to take before it happens.

Accounting tools explain what already happened. Auripeak focuses on what is about to happen. It connects your transactions, invoices, and obligations to show your real liquidity runway and highlight upcoming pressure points.

No. Auripeak does not move money, switch contracts, or sell financial products. The platform exists purely as a financial intelligence layer that helps you stay in control of your cash position.

Spreadsheets require constant manual maintenance and easily break as financial activity grows. Auripeak keeps the same level of control while structuring your data so transactions, invoices, and obligations stay organized and visible.

Auripeak is designed so users remain in control of their financial data. Information is encrypted in transit and at rest, protected by strict access controls, and never sold or shared with third parties.

At launch, transactions can be entered manually or captured through OCR to ensure accurate records. Optional read-only bank connectivity will be introduced later through regulated open-banking providers.

Predictive liquidity intelligence means understanding your financial position before problems appear. Auripeak identifies upcoming gaps, delayed payments, and expense pressure so you can act early rather than react late.

Auripeak is built for people who operate independently — freelancers, consultants, and small business owners who manage their own cash flow. If you depend on invoices arriving on time and expenses never stop coming, the platform helps you stay ahead of that pressure.

Irregular income is exactly what Auripeak is built for. Instead of assuming stable cash cycles, the system tracks upcoming invoices, expected payments, and recurring obligations so you can see how your liquidity will evolve over time.

No. Auripeak is designed so operators can understand their financial position without learning accounting systems. Transactions, invoices, and obligations are structured automatically so you can focus on decisions rather than bookkeeping.

Yes. The platform works for both solo operators and small teams. As a business grows, team members can be given controlled access so financial visibility is shared without losing oversight.

The system is designed to work in minutes rather than requiring a full accounting setup. Once your transactions and invoices are entered, Auripeak begins building a clear picture of your financial runway.

Auripeak highlights uncategorized transactions, irregular spending patterns, and upcoming obligations so pressure becomes visible before it escalates.

No. Accounting software handles compliance and bookkeeping. Auripeak focuses on operational liquidity awareness — helping you understand when cash pressure is approaching and what to do about it.

Transfers between accounts can be marked as internal so they do not distort revenue or expense calculations. This keeps reporting clean and prevents double counting.

Auripeak is currently in early access development. Operators can join the waitlist to get access when the first release becomes available and help shape the direction of the product.

Auripeak follows a straightforward SaaS subscription model. There are no commissions, no financial product incentives, and no hidden monetization tied to user data.

Many financial tools assume stable income cycles and perfect accounting records. Independent operators rarely operate that way. Auripeak was created to reflect the reality of irregular payments, variable expenses, and the need for clear liquidity visibility.

Apply for Early Liquidity Access

Be among the first to eliminate cash-flow uncertainty with Auripeak. Secure early access, influence the roadmap, and help shape the liquidity intelligence layer for European independent operators.